Contents:

In a restaurant chart of accounts, the COGS section will include the same accounts as the revenue section. That way you can eyeball the COGS and revenue for specific item types. Bar and restaurant equity accounts are based on how your business is legally structured.

You should evaluate the true cost of each dish at least once a month if not once a week. The golden rule in merchant processing is to make sure it integrates with your POS system. If you get roped into some external merchant processing device (that doesn’t work with your POS system) you are losing money no matter what the rate is.

Categories

It seems to be the most affordable and easy to use platform. Additionally, what is great is you can run payroll through Square as well. Bars and restaurants can see the short-, medium-, and long-term loans and debts they have.

The two major reasons I recommend outsourcing your payroll are because it is extremely cheap and you get a lot of potential liability off of your business. If you are taking on an investment partner make sure you hash out those details with your CPA and lawyer. You want to make sure to create an owner equity account and to keep your partner distributions in line with your partner agreement. If you are taking money from other people first decide whether it will be a loan or a partner investment. If it is a loan determine the terms of that loan including the interest rate and maturity of the loan.

Restaurant Chart of Accounts | How-To & Template (FREE)

Want to invest some money into a certain marketing activity? Add that to your forecast along with the impact you expect it to have on your sales and bottom line. Then measure your actual performance against expectations to see if you are satisfied with the return on investment. But I highly recommend QBO Plus because of the ability to create budgets (I’ll discuss this more later). They will know the various POS system and how to integrate them with QuickBooks Online.

Managing weekly payables is challenging enough before worrying about making all the correct weekly, monthly, and quarterly tax payments to the correct departments. However, there is a vast difference between being frugal and being cheap. In the service of frugality, I recommend using a full-service payroll provider like Gusto. One of the few businesses that manufacture raw materials and sells them in the same facility, restaurants are truly one of a kind. Based on a rough profit margin of 33% profit-margin based on sales would be $1,650. Conduct your own back of the napkin analysis to estimate whether or not you’ll be able to cover your monthly expenditures.

Food Truck Business Kit – Sign up for my 20 page guide that explains what you’ll need to get started. Download this spreadsheet and plug-in your own numbers to get an overall estimate of what it will cost to get the business up and rolling. Regardless of which file you import, you can modify the sub account assignments after importing to suit your preferences.

Operating Expenses

This includes all your accounts payable to suppliers, along with company credit cards, taxes owed, and more. Your food truck must periodically report sales and payroll amounts to various state, local and federal governments, and pay taxes on these amounts. Food truck sales are classified as retail sales, which are subject to local and state sales taxes in most states.

Most accounting software comes preloaded with a few different chart of account templates. You will be asked what industry you operate within, and then you will be given a preset chart of accounts. I’ve also talked with food truck owners that couldn’t pass their health inspection because their food truck didn’t have the correct fire suppression system installed. Cutting corners to save a few dollars in startup cost isn’t always a good idea.

If done properly it can actually be a tool that you can use to run an incredibly profitable food truck. A properly designed bookkeeping system can be efficient and easy to maintain once set up. You should be analyzing the reports that your bookkeeping system produces. A 3rd party payroll provider will handle all of your payroll tax filings, W-2’s, direct deposits, etc and they will do it extremely cheap. If a payroll tax filing is late or incorrect that is your payroll providers problem, not yours.

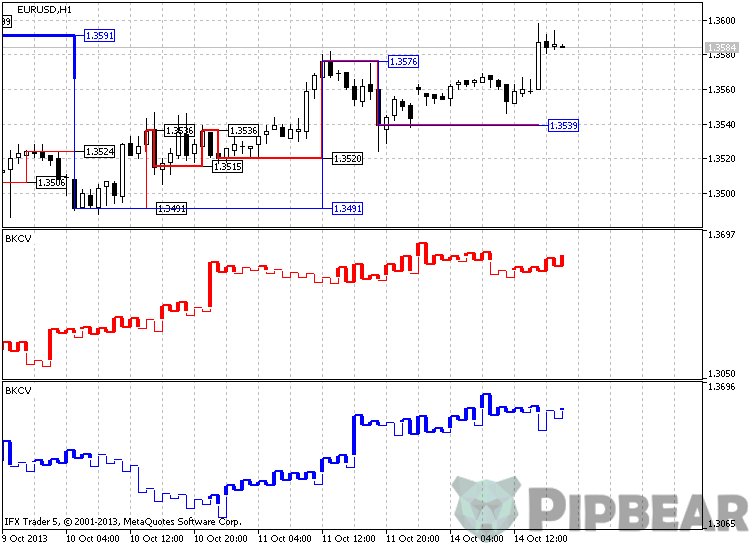

Track account movement

Your income includes all cash and credit card sales received. Outgoing expenses should be recorded with the help of receipts and invoices. Don’t overlook permits and licenses as an ongoing expense. You may want network with other food truck owners to find out some of the various permits and licenses that are required in your area. You may learn some things that you were not aware of that can save you a lot of headaches, time, and money. There are all sorts of variable expenses to understand before becoming a food truck owner.

- While I don’t condone the Profit First method for your accounting system, it does work.

- Some may also display equity accounts on their company’s chart.

- Like many other business owners, food truck owners can get stuck in the weeds in the business.

- 1 ) There has never been a better time than now to cut costs and fees while streamlining your restaurant business.

- We provide third-party links as a convenience and for informational purposes only.

You really want a bookkeeper that understand food trucks for various reasons. Now the real power is in understanding your costs and that they fluctuate. If you intimately know your business expenses and vendors you will notice price fluctuations.

And it’s extremely expensive and time consuming to bring in new customers. Don’t underestimate how much this cost will be and budget accordingly. Will additional equipment be needed after purchasing the truck? Maybe you need to make some modifications to the cooking area and you most likely will need to design the outside of your truck with your brand and logo.

Some ingredients will be absolutely necessary and so will certain vendors. You might want to look into the regulations you have to comply with locally by looking into the permit to operate a food truck. There may be other large expenses you have not thought about such as a fire suppression system. Personally, the best POS system I have seen for food trucks is Square.

The following report, which you can also view as a PDF, shows the second file layout using sub-accounts. You can also view a PDF of the simple layout without sub-accounts. Whether you’ve started a small business or are self-employed, bring your work to life with our helpful advice, tips and strategies.

Your food truck cooks and servers depend on your payroll system provide weekly paychecks and withhold income and Social Security and Medicare taxes. Most food truck employees earn wages rather than salaries; multiply employee hours by their hourly wage to determine base payroll amounts. In some cases, service window staff are also liable for payroll taxes on income they earn in tips, so ask them to report their tip income on their time sheets. We have created two different variations our default chart of accounts in the Quickbooks format, one in a simple list and one that uses a sub-account structure. In the first file format, all accounts are listed without any parent account structure.

P.A.M. Transportation Services, Inc. Announces Results for the First … – EIN News

P.A.M. Transportation Services, Inc. Announces Results for the First ….

Posted: Mon, 24 Apr 2023 21:22:00 GMT [source]

All of the time wasted in handling money, going to the bank, etc is easily offset by a simple merchant fee. Additionally, you will earn more customers with electronic payments. If I were a food truck owner I would only accept credit cards…period. Do not use personal bank accounts and credit cards unless absolutely necessary. All you are doing is causing you or your accountant a ton of work that costs money.

Photos: Trump’s first 100 days – Business Insider

Photos: Trump’s first 100 days.

Posted: Sat, 29 Apr 2017 07:00:00 GMT [source]

We highly recommend them to entrepreneurs and small business owners looking for targeted evaluation and feedback. You can rest assured that we will work closely with you to create actionable business plans and accurate financial reporting. We offer our toolkit of financial intelligence that will be your greatest asset for business growth. However, make sure to look at a profit and loss that lists each line item as a percentage of income. This is a simple report to produce in QuickBooks Online and it can be very powerful.

- Because of this many use computer programs to help record their financial information.

- It is best to prepare a P&L each week if at all possible.

- Want to invest some money into a certain marketing activity?

- This includes all your accounts payable to suppliers, along with company credit cards, taxes owed, and more.

- Let’s look into each briefly, then see how they all come together in a restaurant chart of accounts.

Instead, take advantage of your work in processing software’s sub-accounts. For instance, if you rent, the money moves from your cash account to the rent expense account. Expense accounts allow you to keep track of money that you no longer have.