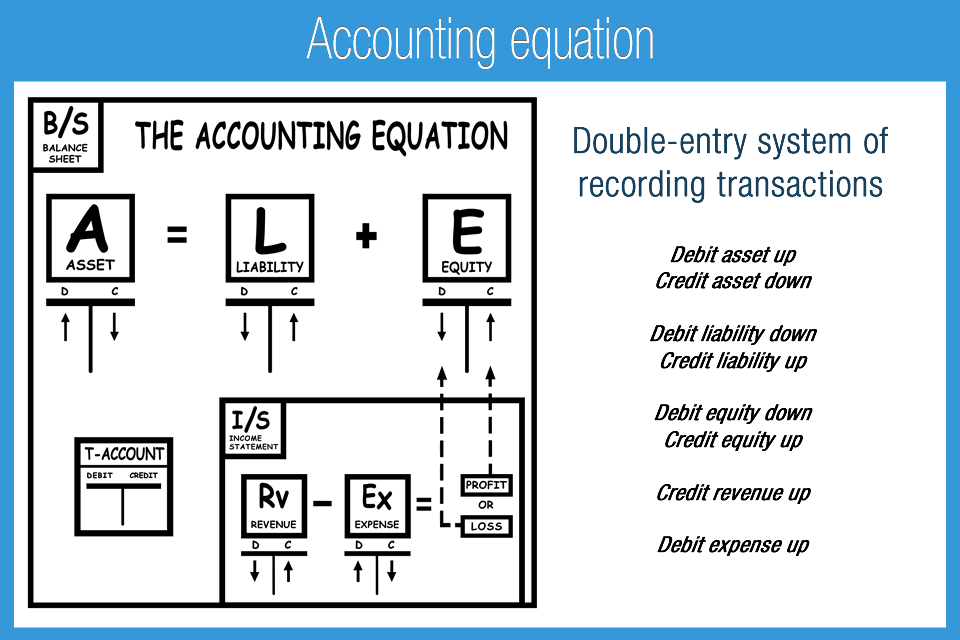

This equation holds true for all business activities and transactions. If assets increase, either liabilities or owner’s equity must increase to balance out the equation. The fundamental accounting equation, also called the balance sheet equation, is the foundation for the double-entry bookkeeping system and the cornerstone of accounting science. In the accounting equation, every transaction will have a debit and credit entry, and the total debits (left side) will equal the total credits (right side). In other words, the accounting equation will always be “in balance”. This straightforward relationship between assets, liabilities, and equity is considered to be the foundation of the double-entry accounting system.

Impact of transactions on accounting equation

- Think of retained earnings as savings, since it represents the total profits that have been saved and put aside (or “retained”) for future use.

- For every business, the sum of the rights to the properties is equal to the sum of properties owned.

- Anushka will record revenue (income) of $400 for the sale made.

- The following illustration for Edelweiss Corporation shows a variety of assets that are reported at a total of $895,000.

- These financial documents give overviews of the company’s financial position at a given point in time.

Finally, a corporation is a very common entity form, with its ownership interest being represented by divisible units of ownership called shares of stock. Corporate shares are easily transferable, with the current holder(s) of the stock being the owners. Earnings give rise to increases in retained earnings, while dividends (and losses) cause decreases. You can find a company’s assets, liabilities, and equity on key financial statements, such as balance sheets and income statements (also called profit and loss statements). These financial documents give overviews of the company’s financial position at a given point in time. The accounting equation ensures the balance sheet is balanced, which means the company is recording transactions accurately.

Part 2: Your Current Nest Egg

Implicit to the notion of a liability is the idea of an “existing” obligation to pay or perform some duty. This transaction also generates a profit of $1,000 for Sam Enterprises, which would increase the owner’s equity element of the equation. On 2 January, Mr. Sam purchases a building for $50,000 for use in the business. The impact of this transaction is a decrease in an asset (i.e., cash) and an addition of another asset (i.e., building).

4: The Basic Accounting Equation

That part of the accounting system which contains the balance sheet and income statement accounts used for recording transactions. In our examples below, we show how a given transaction affects the types of bookkeeper. We also show how the same transaction affects specific accounts by providing the journal entry that is used to record the transaction in the company’s general ledger. Although the balance sheet always balances out, the accounting equation can’t tell investors how well a company is performing.

Ted decides it makes the most financial sense for Speakers, Inc. to buy a building. Since Speakers, Inc. doesn’t have $500,000 in cash to pay for a building, it must take out a loan. Speakers, Inc. purchases a $500,000 building by paying $100,000 in cash and taking out a $400,000 mortgage. This business transaction decreases assets by the $100,000 of cash disbursed, increases assets by the new $500,000 building, and increases liabilities by the new $400,000 mortgage.

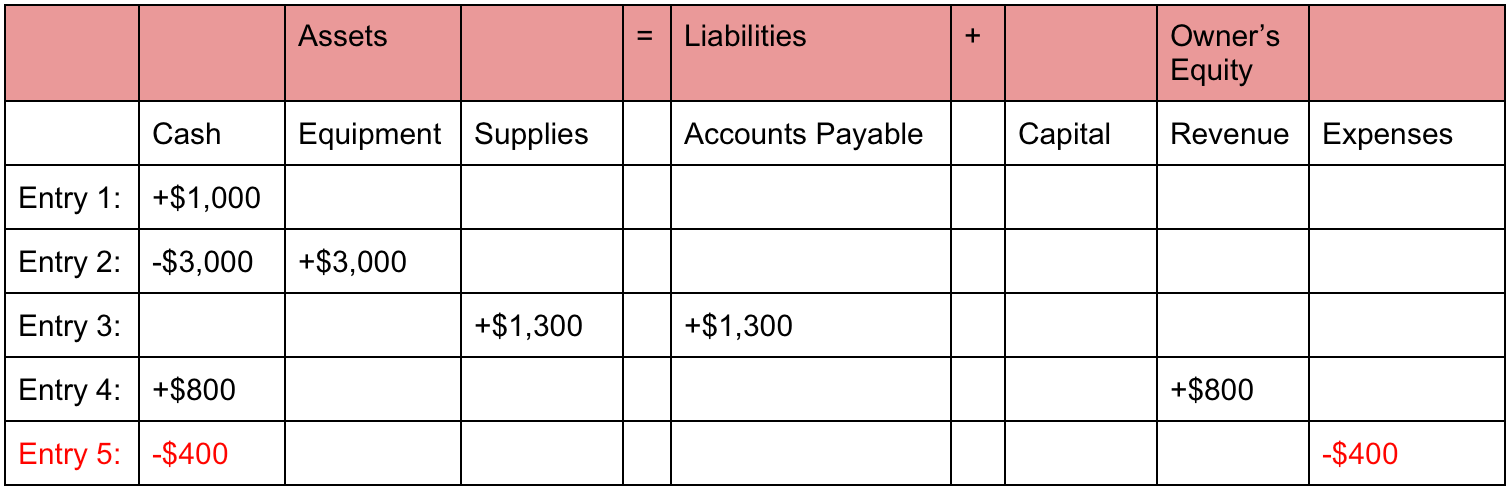

Effect of Transactions on the Accounting Equation

It is based on the idea that each transaction has an equal effect. It is used to transfer totals from books of prime entry into the nominal ledger. Every transaction is recorded twice so that the debit is balanced by a credit. For a company keeping accurate accounts, every business transaction will be represented in at least two of its accounts. For instance, if a business takes a loan from a bank, the borrowed money will be reflected in its balance sheet as both an increase in the company’s assets and an increase in its loan liability.

Additionally, you can use your cover letter to detail other experiences you have with the accounting equation. For example, you can talk about a time you balanced the books for a friend or family member’s small business. The accounting equation will always remain in balance if the double entry system of accounting is followed accurately.

The assets have been decreased by $696 but liabilities have decreased by $969 which must have caused the accounting equation to go out of balance. To calculate the accounting equation, we first need to work out the amounts of each asset, liability, and equity in Laura’s business. Like any brand new business, it has no assets, liabilities, or equity at the start, which means that its accounting equation will have zero on both sides. Essentially, the representation equates all uses of capital (assets) to all sources of capital, where debt capital leads to liabilities and equity capital leads to shareholders’ equity. Equity refers to the owner’s interest in the business or their claims on assets after all liabilities are subtracted.

It can also cause problems with taxes and audits, as well as customers who may suspect fraud or mishandling of funds as a result of an unbalanced equation. And we find that the numbers balance, meaning Apple accurately reported its transactions and its double-entry system is working. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. The difference between the sale price and the cost of merchandise is the profit of the business that would increase the owner’s equity by $1,000 (6,000 – $5,000). For every business, the sum of the rights to the properties is equal to the sum of properties owned. Drawings are amounts taken out of the business by the business owner.

So, as long as you account for everything correctly, the accounting equation will always balance no matter how many transactions are involved. Valid financial transactions always result in a balanced accounting equation which is the fundamental characteristic of double entry accounting (i.e., every debit has a corresponding credit). Under the accrual basis of accounting, expenses are matched with revenues on the income statement when the expenses expire or title has transferred to the buyer, rather than at the time when expenses are paid. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). The balance sheet reports the assets, liabilities, and owner’s (stockholders’) equity at a specific point in time, such as December 31.

In this example, we will see how this accounting equation will transform once we consider the effects of transactions from the first month of Laura’s business. If you’re still unsure why the accounting equation just has to balance, the following example shows how the accounting equation remains in balance even after the effects of several transactions are accounted for. The accounting equation shows the amount of resources available to a business on the left side (Assets) and those who have a claim on those resources on the right side (Liabilities + Equity). The combined balance of liabilities and capital is also at $50,000. The double-entry practice ensures that the accounting equation always remains balanced, meaning that the left-side value of the equation will always match the right-side value.