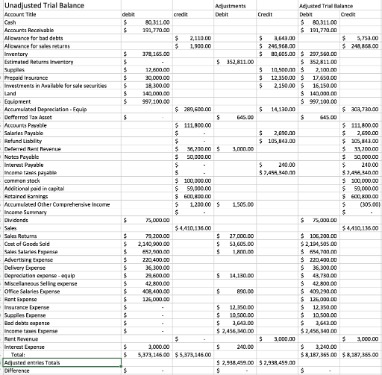

This is because any overdue receivables from the year prior are already accounted for in the receivables balance for the current period. The matching principle states that companies must record all expenses and the revenue connected to them in the same period. Per the allowance method, companies create an allowance for doubtful accounts (AFDA) entry at the end of the fiscal year.

How one of Pakistan’s oldest banks cleaned up its act – Profit by Pakistan Today

How one of Pakistan’s oldest banks cleaned up its act.

Posted: Sun, 03 Sep 2023 05:09:15 GMT [source]

A reserve for doubtful debts can not only help offset the loss you incur from bad debts, but it also can give you valuable insight over time. For example, your ADA could show you how effectively your company is managing credit it extends qualitative characteristics of accounting information overview, guide to customers. It can also show you where you may need to make necessary adjustments (e.g., change who you extend credit to). As mentioned earlier in our article, the amount of receivables that is uncollectible is usually estimated.

Presentation of bad debt expense on income statement

A bad debt expense is a portion of accounts receivable that your business assumes you won’t ever collect. Also called doubtful debts, bad debt expenses are recorded as a negative transaction on your business’s financial statements. You track bad debts on the balance sheet as well, using the bad debt reserve account, also known as an allowance for bad debt. Unlike the income statement, which focuses on bad debts in the current reporting period, the bad debt reserve includes bad debts from previous periods as well. However, the direct write-off method can result in misstating the income between reporting periods if the bad debt journal entry occurred in a different period from the sales entry. The journal entry for the direct write-off method is a debit to bad debt expense and a credit to accounts receivable.

This is recorded as a debit to the bad debt expense account and a credit to the allowance for doubtful accounts. The actual elimination of unpaid accounts receivable is later accomplished by drawing down the amount in the allowance account. When it becomes apparent that a specific customer invoice will not be paid, the amount of the invoice is charged directly to bad debt expense.

What Type of Asset Is Bad Debt?

Collaborative AR makes it easier for your AR staff to communicate with customers to clear up issues that often lead to payment delays, such as disputed invoice charges or missing remittance information. Instead of sifting through multiple email threads, AR staff and customers alike can find all the information they need in one place. This method is similar to the percentage of sales method but uses AR instead of sales. It’s also worth noting that your historical percentage of collections will likely vary between bullish and bearish economic cycles.

Historically, ABC usually experiences a bad debt percentage of 1%, so it records a bad debt expense of $10,000 with a debit to bad debt expense and a credit to the allowance for doubtful accounts. The bad debt expense calculation under the allowance method can be determined in a number of ways. Another option is to apply an increasingly large percentage to later time buckets in which accounts receivable are reported in the accounts receivable aging report. Finally, one might base the bad debt expense on a risk analysis of each customer. No matter which calculation method is used, it must be updated in each successive month to incorporate any changes in the underlying receivable information. When sales transactions are recorded, a related amount of bad debt expense is also recorded, on the theory that the approximate amount of bad debt can be determined based on historical outcomes.

Bad debt expense definition

Bad debt is any credit advanced by any lender to a debtor that shows no promise of ever being collected, either partially or in full. Any lender can have bad debt on their books, whether that’s a bank or other financial institution, a supplier, or a vendor. Bad debt expense helps you quantify lost receivables and measure collection effectiveness.

- As you can tell, there are a few moving parts when it comes to allowance for doubtful accounts journal entries.

- Bad debt is accounted for by crediting a contra asset account and debiting a bad expense account, which reduces the accounts receivable.

- Another option is to apply an increasingly large percentage to later time buckets in which accounts receivable are reported in the accounts receivable aging report.

- Bad debt refers to the amount of money that must be written off by a creditor as a result of a default on the part of the debtor.

- The formula uses historical data from previous bad debts to calculate your percentage of bad debts based on your total credit sales in a given accounting period.

Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs. Bad debt is debt that creditor companies and individuals can write off as uncollectible. Impairment of individually non-significant balances can be measured on a portfolio or group basis. Any receivables that are not thought to be impaired are included in the group assessment.

Company

If your company has enough business history to reference how collections performed in different economic cycles, this can be helpful for casting predictions. When the billing and payment experience isn’t optimized, overall customer experience suffers. Wakefield Research and Versapay’s survey on the state of digitization in B2B finance reveals the extent of this disconnect. Eighty-five percent of c-level executives surveyed said miscommunication between their AR department and a customer has resulted in the customer not paying in full. Companies retain the right to collect these receivables should conditions change. Even if the further $200 is recovered from ABC Company, it will not affect the receivables account because in either case, the receivables account is credited by the whole amount.

If a customer purchases from you but does not pay right away, you must increase your Accounts Receivable account to show the money that is owed to your business. If you use double-entry accounting, you also record the amount of money customers owe you. Bad debt expense is something that must be recorded and accounted for every time a company prepares its financial statements. When a company decides to leave it out, they overstate their assets and they could even overstate their net income. On March 31, 2017, Corporate Finance Institute reported net credit sales of $1,000,000.

Direct write-off method

The collective assessment of impairment requires the splitting of the list of receivables into groups of trade receivables that share similar credit risk characteristics. The credit risk groups are to be assessed for impairment using historical loss experience for each group. Such historical loss experience would be adjusted to reflect the effects of current conditions. The entries mean that the business already has an allowance brought forward from the previous year’s statement of financial position. Bad Debt Expense increases (debit), and Allowance for Doubtful Accounts increases (credit) for $22,911.50 ($458,230 × 5%).

Bad debt is a contingency that all businesses that extend credit to customers must account for because there is always a risk that payment will not be collected. These entities may estimate the amount of their accounts receivables that may become uncollectible through the use of either the direct write-off method or the allowance method. Explore how businesses use the allowance method for bad debt and how to calculate bad debt expenses. The original journal entry for the transaction would involve a debit to accounts receivable, and a credit to sales revenue.